For the reason that world mentioned goodbye to 2022 seven months in the past, over half of Bangladesh’s listed non-bank monetary establishments (NBFIs) have violated securities legal guidelines by failing to reveal their monetary accounts for the yr.

Because of this, the efficiency of the non-banks throughout the yr was unknown to a whole bunch of 1000’s of normal buyers who held the shares of the companies. The fiscal yr for NBFIs extends from January to December.

The annual monetary statements of listed companies, besides mutual funds, have to be audited in accordance with itemizing requirements inside 120 days after the tip of the issuers’ fiscal year.

And inside 14 days after the audit, the report have to be launched. This means that by the center of Might, NBFIs should launch their annual statements.

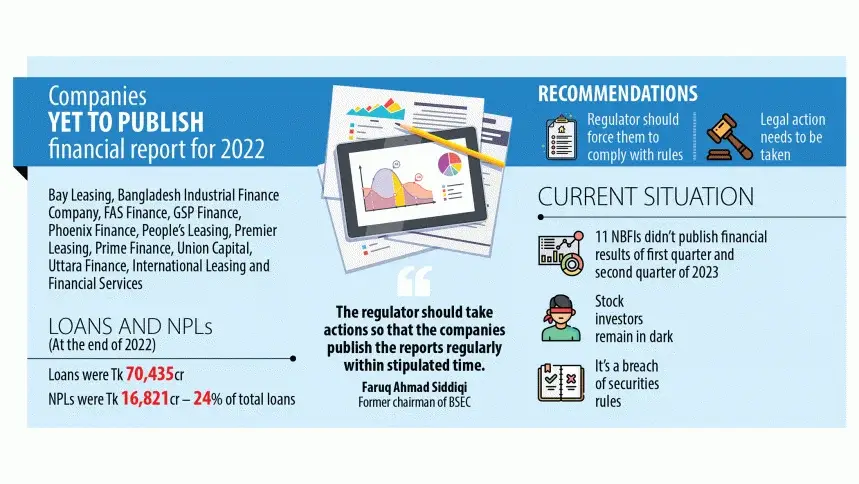

At the moment, the Dhaka Inventory Change (DSE) lists 23 NBFIs. 11 of them nonetheless have not launched their monetary experiences by the deadline.

These companies included Bay Leasing, Bangladesh Industrial Finance Firm, FAS Finance, GSP Finance, Phoenix Finance, Folks’s Leasing, Premier Leasing, Prime Finance, Union Capital, and Uttara Finance.

The 12 companies who punctually issued their monetary experiences for 2022 likewise did so for the primary and second quarters of 2023. The primary two quarters of monetary reporting from the 11 NBFIs have been additionally missed.

Former head of the Bangladesh Securities and Change Fee (BSEC), Faruq Ahmad Siddiqi, acknowledged: “Inventory buyers stay in the dead of night if corporations do not publish experiences regularly.”

Transparency Crucial: Well timed Monetary Reporting in NBFIs for Knowledgeable Investor Confidence

“NBFIs ought to launch their monetary experiences on time, no matter how effectively or poorly their funds are doing, what number of non-performing loans they’ve, or how a lot loss they’re experiencing.”

“Traders have a proper to know the state of affairs of the businesses,” he declared, pleading with the BSEC to take acceptable motion.

Nearly all of non-compliance with relation to the submission of monetary experiences was seen at NBFIs that suffered losses or companies that have been the goal of irregularities.

These companies included Bay Leasing, Bangladesh Industrial Finance Firm, FAS Finance, GSP Finance, Phoenix Finance, Folks’s Leasing, Premier Leasing, Prime Finance, Union Capital, and Uttara Finance.

In accordance with its most up-to-date statistics, GSP Finance outperformed the others, whereas the others noticed losses, in response to DSE knowledge.

Huge NPLs and irregularities are the important thing issues dealing with the vast majority of NBFIs that haven’t launched monetary experiences.

In accordance with BB statistics, NPLs within the NBFI sector have been Tk 16,821 crore in 2022, or over 1 / 4 of the whole excellent funds issued by non-banks.

In accordance with BB statistics, NPLs within the NBFI sector have been Tk 16,821 crore in 2022, or over 1 / 4 of the whole excellent funds issued by non-banks.

Solely Union Capital offered a proof for the delay in making the monetary experiences for 2022 public out of the 11 non-compliant NBFIs.

The BB has been requested by the non-bank to rethink its resolution to use curiosity on the loans made to Unicap Investments Restricted.

A mortgage has been given to Union Capital’s subsidiary. The NBFI countered that as a result of the shoppers are experiencing important losses, the subsidiary can’t gather curiosity on the margin loans.

Subsequently, if Union Capital had charged curiosity, the subsidiary would have suffered a considerable loss, which might in the end irritate the subsidiary’s monetary state of affairs.

Subsequently, if Union Capital had charged curiosity, the subsidiary would have suffered a considerable loss, which might ultimately irritate the group’s monetary state of affairs.

The NBFI is unable to finish the audited monetary accounts for 2022 for the reason that drawback has not but been resolved.

Md. Abdul Hannan, firm secretary for Union Capital, acknowledged, “We’ve obtained the BB’s resolution, and we’ll take the subsequent step pursuant to the board’s instruction.” He mentioned nothing additional.

In March of present yr, Union Capital’s NPL was Tk 595 crore.

Worldwide Leasing and Monetary Providers was the mortgage holder with the most important defaulted mortgage, totaling Tk 3,755 crore.

FAS Finance & Funding obtained Tk 1,649 crore, Uttara Finance obtained Tk 1,013 crore, and Folks’s Financial institution obtained Tk 907 crore.

In accordance with statistics from the central financial institution, the quantities have been Tk 1,649 crore for FAS Finance & Funding, Tk 1,013 crore for Uttara Finance, Tk 907 crore for Folks’s Leasing, Tk 967 crore for Phoenix Finance, and Tk 755 crore for Bangladesh Industrial Finance Firm.

Folks’s Leasing’s company secretary, Md. Armia Fakir, mentioned that the Excessive Courtroom ordered the enterprise to be liquidated.

Later, the enterprise was permitted to proceed. The board has undergone many restructurings throughout the previous three years.

“The enterprise is present process a transition. Subsequently, the audit report isn’t out there on-line,” he acknowledged.

The monetary experiences haven’t been launched, in response to Md. Zahid Mahmud, firm secretary of FAS Finance & Funding, for the reason that audit operations haven’t but been completed.

The monetary experiences haven’t been launched, in response to Md. Zahid Mahmud, firm secretary of FAS Finance & Funding, for the reason that audit operations haven’t but been completed.

Fareast Finance’s company secretary, Md. Ramzan Hossain, acknowledged that the monetary report for 2022 has already been accepted, audited, and forwarded to the suitable authorities.

It is going to shortly be revealed on the enterprise’ web site and in newspapers.

Nearly all of NBFIs, in response to a high official of the BSEC, have requested extensions to submit monetary experiences.

On the opposite facet, different companies are having bother with growing NPLs and losses. We’re working to get issues ahead extra rapidly.

Premier Leasing’s Subash Chandra Moulick and Prime Finance’s Mohammad Zaman each claimed that the companies have obtained new funding.

The central financial institution has given the companies extra time, in response to the corporate secretaries of Premier Leasing and Prime Finance, Subash Chandra Moulick and Mohammad Zaman.

Though buyers are conscious that almost all NBFIs are struggling as a consequence of a better fee of unhealthy loans, in response to Md Sayadur Rahman, head of the Bangladesh Service provider Bankers Affiliation, they need to know the true state of affairs by trying on the monetary accounts.

Traders are left in the dead of night and have bother making funding choices if corporations do not publish monetary experiences.